Capital gains on land sale calculator

The tax is 5 final tax or 25 from 8 September 2016 on the taxable. Any short-term gains you realize are included with your other sources of income for the year for tax purposes.

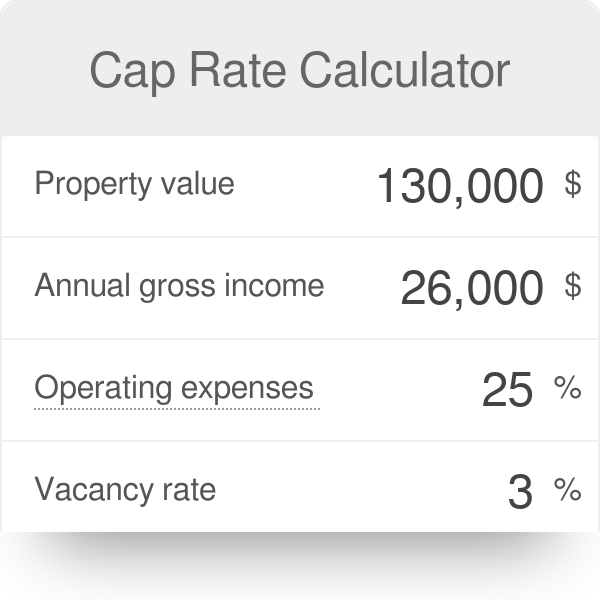

Cap Rate Calculator

145 per share paying a total of Rs.

. There is option to include cost of repairsimprovement that you might. So if you have 20000 in short-term gains and earn 100000 in salary from your day job the IRS considers your total taxable income to be 120000. In this instance the taxpayer would pay 0 percent of capital gains tax on the amount of capital gain that fit into the 15 percent marginal tax bracket.

This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Capital Gains Account Scheme. The head Short Term Capital Gains 15 refers to short term capital gains taxed at the STCG tax rate equal to 15 of total gains.

You need to feed your property sale purchase date along with values. Astral Poly Tech 13355. The formula to check the indexed purchase price of the asset is.

Capital gains from the sale of shares by a company owning 10 or more is entitled to participation exemption under certain terms. NSE Gainer-Large Cap. To encourage the reinvestment of the capital gains that are made on the sale of the capital assets through the seller the Indian government has given the relief from the tax of the capital gains if such capital gains are reinvested in some specific assets in a mentioned time limit.

Capital gain tax on sale of rural Agriculture land. Apart from federal income tax the capital gains calculator also. Know about LTCG STCG assets calculation exemption how to save tax on agricultural land.

Read on to find out how to distinguish between short-term and long-term capital assets and calculate the gains in each case. This would include gains from property unlisted equity shares debt mutual funds etc. So if you have assets not limited to property that you earned income on you can lower your gains by.

For example Mr Arora purchased a property on 1 August 2004 for Rs75 lakh. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real. The taxpayer will have to recognize a capital gain from the sale of the land.

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. Claiming capital losses. When capital gain from sale of a long-term asset other than a house.

Capital Gains Tax. If you have less than a 250000 gain on the sale of your home or 500000 if youre married filing jointly you will not have to pay capital gains tax on the sale of your home. Subtract the cost of capital gain from the selling price of the property to know the net gain of the transaction.

Yes the facts reveal that any sale of agricultural land capital gains us 214 is free from tax liability. Any profit or gain that arises from the sale of a capital asset is a capital gain. The calculator based on your input calculates both short-term capital gains as well as long-term capital gains tax.

The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. According to section 214 rural agriculture land is not considered as a capital asset thats why Income tax wont be levied on the sale of rural agricultural land. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. Sandeep bought 250 shares of a listed company in October 2014 at a cost of Rs. You can also claim capital losses when you have capital gains.

Capital Gains Tax Due Formula Sales Price - Present Value of Total Purchase Price including conveyancing and surveyors fees Present Value of Enhancement Costs Selling Costs 1270 X 33 1270 per person ie 2540 for a married couple where the asset is jointly owned. Sale of land andor buildings located in Indonesia. Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most significant one being the family homeRollover provisions apply to some disposals one of the most significant of which are transfers to beneficiaries on death so that the CGT is not a quasi.

The capital gains rate as per the Union Budget 2020 can be given as belowLong-term capital gains on equity shares are taxed at 10 without any indexation benefitIn the Interim Budget 2020 there are no changes made to the provisions that govern the long-term capital gains LTCG on the sale of stocks. It calculates both Long Term and Short Term capital gains and associated taxes. The head Short Term Capital Gains refers to short term capital gains taxed as per the applicable income tax slab rate.

Cost of purchase multiplied by CII of the year of sale divided by CII of the year of purchase Let us tweak the above example a bit to illustrate long-term capital gains. This gain is charged to tax in the year in which the transfer of the capital asset takes place. In most of the cases the available time limit is longer and sometimes.

Agricultural land except land situated within or in area up to 8 km. Long-Term Capital Gains Tax in Georgia. The Cost Inflation Index CII for the financial year 2022-23 is 331.

For the 2020 tax year the short-term capital gains tax rate equals your ordinary income tax rate your tax bracket. September 3 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket.

For an individual gain from the sale of a primary private dwelling held for at least 3.

Property Tax How To Calculate Local Considerations

Tax Calculator For Rental Property Best Sale 50 Off Www Ingeniovirtual Com

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Tax What Is It When Do You Pay It

Capital Gain Tax Calculator 2022 2021

Capital Gain Formula Calculator Examples With Excel Template

Nri Foreign Income Tax Faqs Eztax In

Capital Gains Tax Calculator The Turbotax Blog

Cleartax 39 S Guide To Tax Implications On Capital Gains From Sale Of Shares House Property Filing Taxes Tax Refund Income Tax Return

2022 Capital Gains Tax Rates By State Smartasset

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Being A Landlord Budget Spreadsheet

Property Tax Calculator

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks

Capital Gains Calculator

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit