15+ 200000 mortgage

Table of Contents 200000 monthly mortgage payment. Note that your monthly mortgage payments.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

This report is also known as The Cost of Raising a Child USDA has been tracking the cost of raising a child since 1960 and this analysis examines expenses by age of child household income budgetary component and region of the country.

. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. But if you can put 10 15 or even 20 down you. Doctor mortgage loans also known as physician mortgage loans are being offered by an increasing number of banks and to an increasing number of high-income professionals other than just doctors.

This money goes to the Federal Emergency Management Agency which uses the data to plan ahead for emergencies and to target high. The borrower would need to buy a cheaper housea 200000 mortgage at 4 for 15-years results in a 1479 payment. The monthly payment on a 200000 mortgage is 1348 for a 30 year-loan and 1879 for a 15 year one.

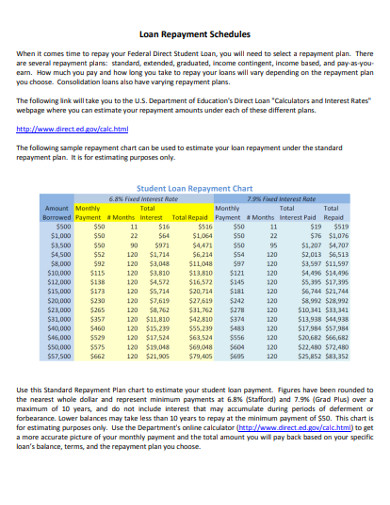

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. At the midway point of 15 years PMI should automatically cancel Baker says. The following table shows loan balances on a 200000 home loan after 5 10 15 20 years for loans on the same home.

15 photos Bears After Dark With Cody Whitehair Nov 15 2017. Interest Rate APR 3055. 29 photos More in Latest Galleries CBS2 Chicago.

Once you reach 20 equity in your home you may be. The average 15-year fixed mortgage APR is 5230 according to Bankrates latest survey of the nation. Latest breaking news including politics crime and celebrity.

Middle-income parents will spend an average of 310605 by the time a child turns 17 between 2015 and 2032. Mortgage interest rates are always changing and there are a lot of factors that. Thats about two-thirds of what you borrowed in interest.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

For today Wednesday September 07 2022 the national average 15-year fixed mortgage APR is 5350 up compared to last weeks of 5230. Find out how much you can afford. Home Loan Amortization Table Payment Month Principal Interest Total Payment.

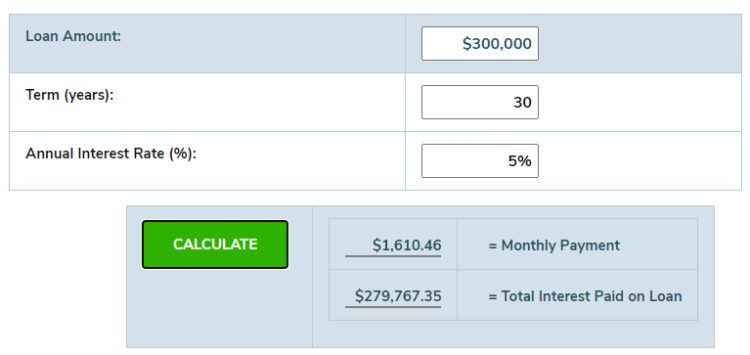

Your total interest on a 200000 mortgage. Mortgage Type 15-YR FRM 30-YR FRM. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Mortgage Type 15-YR FRM 30-YR FRM. You can buy a home worth 220000 with a 20000 down payment and a 200000 mortgage. The following table shows loan balances on a 200000 home loan after 5 10 15 years for loans on the same home.

Todays national 15-year mortgage rate trends. The largest expense associated with raising a child is housing followed by food. After deferring gratification for 10-15 years many of us are in a bit of a rush and we often have a much better use for our money than a down.

This means that if you take out a mortgage worth 200000 you can expect closing costs to be about 6000 12000. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. On Wednesday September 07 2022 the national average 30-year fixed mortgage APR is 6030.

On average Americans spend 15000 on a single home renovation project 1Following the effects of COVID-19 homeowners spent 48 less on their renovation costs than prior to the pandemic 2 likely due to financial strainPeople reported being more cautious with their renovation spend by turning to do-it-yourself projects and more budget-friendly finishes to. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. Youll have to pay primary mortgage insurance PMI with your 15-year fixed-rate loan if your down payment is less than 20.

They could withdraw some of the equity by refinancing into a bigger loan. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

You may need to pay 15 25 for a flood certification. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. September 07 2022 0715 PM.

The monthly cost for a 200000 mortgage was about 1200 per month not including taxes and insurance. Contact Us Stream CBS News Chicago. The alternative minimum tax AMT is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals estates and trustsAs of tax year 2018 the AMT raises about 52 billion or 04 of all federal income tax revenue affecting 01 of taxpayers mostly in the upper income ranges.

Interest Rate APR 31. Remove mortgage insurance premium MIP on FHA loans. Monthly payments on a 200000 mortgage.

Based on the most recent data from the Consumer. Bulk Deals Standard Chartered Bank offloads 138 crore shares in CG Power Steadview sells 08 stake in Yaari Digital. Monthly Principal Interest.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. September 07 2022 0715 PM. Find stories updates and expert opinion.

On the other hand a 30-year loan for 250000 would result in a 1194. Post 2008 rates declined steadily. USDA recently issued Expenditures on Children by Families 2015.

For example say a homeowner owes 100000 on their mortgage but their home is now valued at 200000 due to appreciation. This typically costs 5 1 of your loan amount per year spread over 12 payments. Monthly Principal Interest.

See the table below for an example of amortization on a 200000 mortgage. A 15-year mortgage will have higher monthly payments than a 30-year mortgage loan because youre paying the loan. 60 5 years in 36443.

Free 8 Sample Mortgage Calculator Templates In Pdf Ms Word

Free 5 Sample Annual Payment Calculator Samples In Xls

Loan Schedule 15 Examples Format Pdf Examples

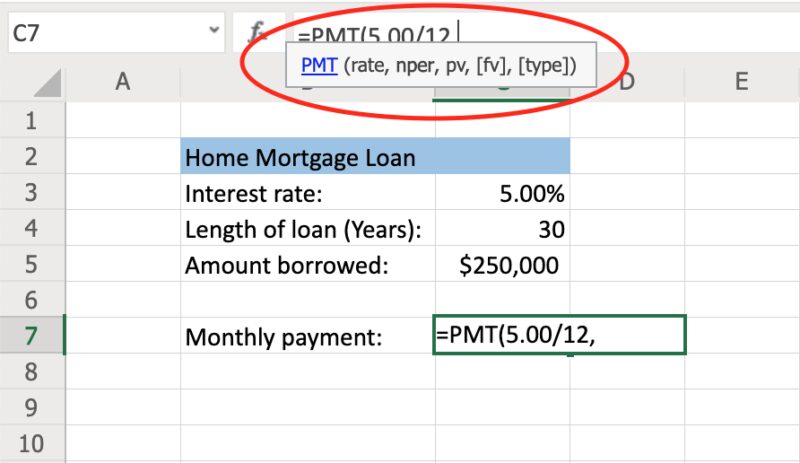

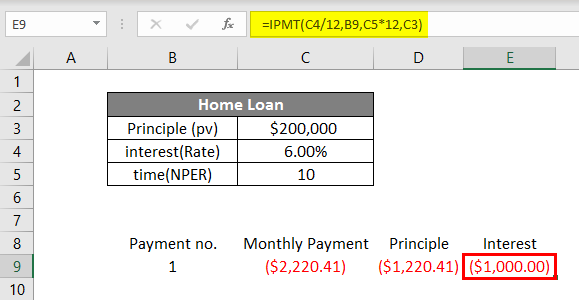

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

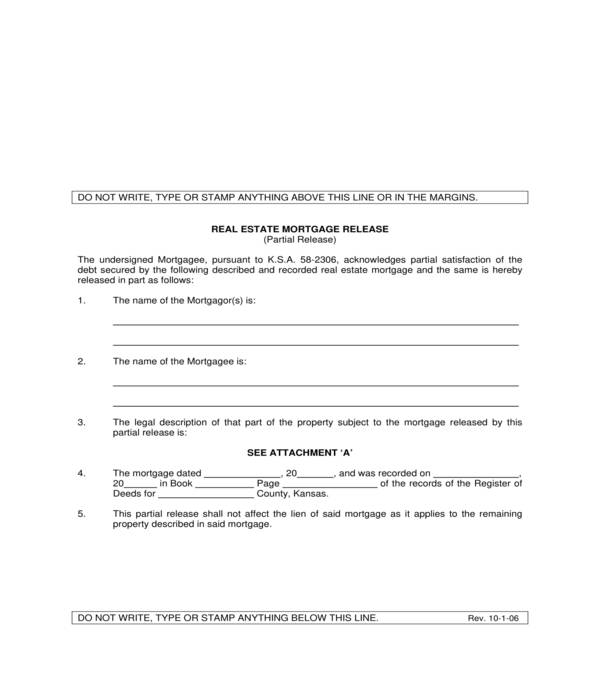

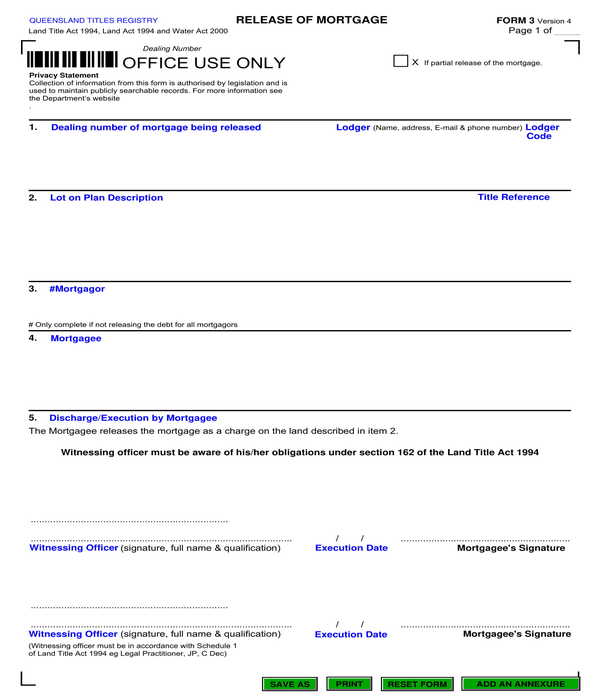

Free 6 Mortgage Release Forms In Pdf Ms Word

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Loan Interest Calculator How Much Will I Pay In Interest

Free 6 Mortgage Release Forms In Pdf Ms Word

Free 10 Mortgage Payoff Statement Samples In Pdf

How To Calculate Monthly Loan Payments In Excel Investinganswers

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Free 10 Mortgage Payoff Statement Samples In Pdf

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 8 Sample Mortgage Calculator Templates In Pdf Ms Word

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free 8 Sample Mortgage Calculator Templates In Pdf Ms Word